GST increase Singapore 2022

Policy makers are also exploring options for taxing other forms of wealth besides property. Read more at wwwtnpsg.

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

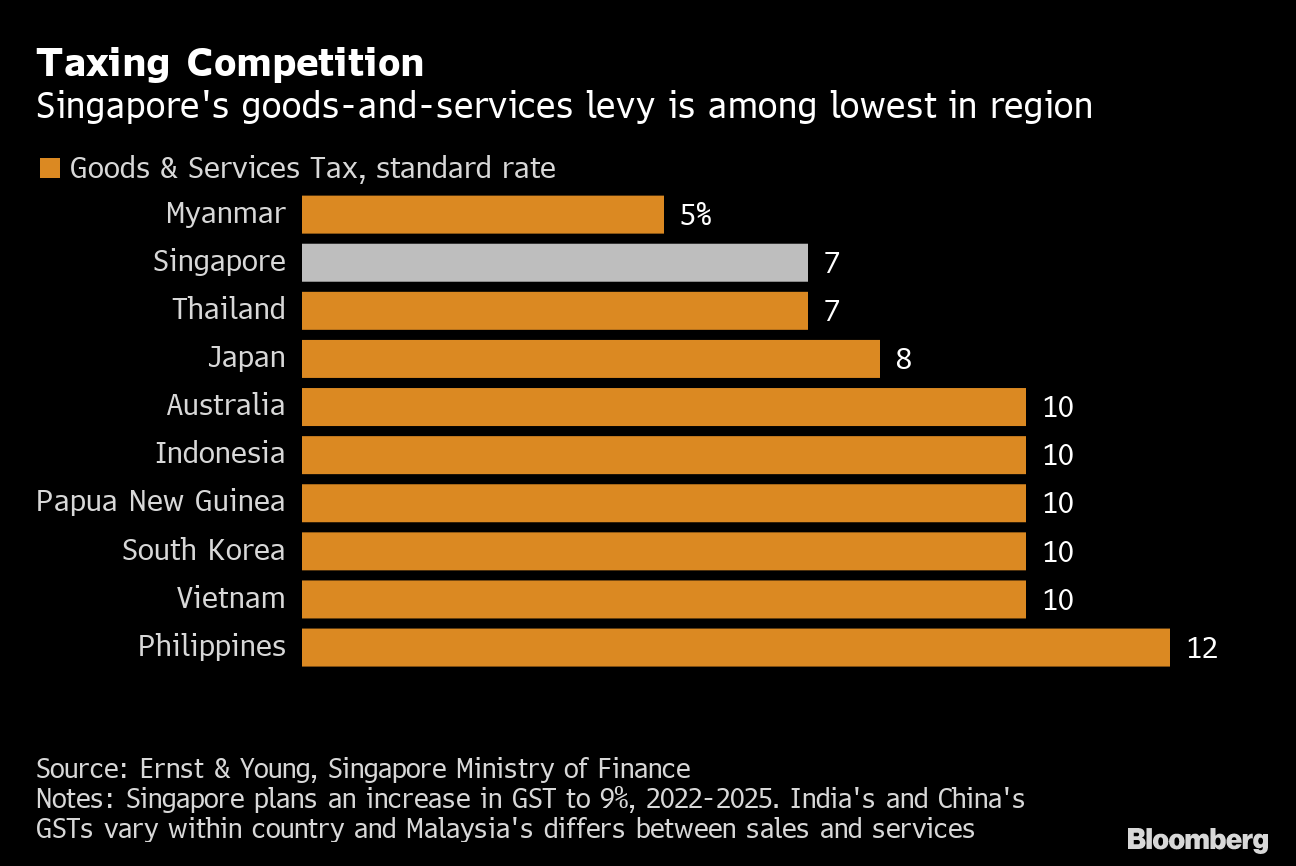

The planned GST hike from 7 per cent to 9 per cent was announced in Budget 2018.

. The planned hike from 7 per cent to 9 per cent was announced. In his new year message for 2022 Singapores Prime Minister Lee Hsien Loong estimated that the countrys gross domestic product GDP will grow between 3 to 5 in 2022. It was first introduced in 1994 at three per cent then raised to four per cent in 2003 and five per cent in 2004.

The Central Board of Indirect Taxes and Customs ie CBIC has recently announced an increase in the goods and service tax rates GST rates on different types of textiles garments and footwear from 5 to 12 effective from January 1 2022. A 22-year-old man was arrested on Wednesday Dec 29 for allegedly transmitting obscene materials through the online content platform OnlyFans said the police. The Government announced that Singapores Goods and Services Tax GST would be raised from 7 to 9 sometime between 2022 to 2025.

2 days agoThe government had previously said that the GST increase - by 2 percentage points to 9 per cent - would take place at some point between 2022 and 2025 with the expectation to implement it sooner. Budget 2022 will lay the basis for sound and sustainable government finances for. Singapores GDP to grow 3-5 in 2022 says PM Lee as he outlines reasons for coming GST increase Budget 2022 will lay the basis for sound and sustainable government finances for the next stage of Singapores development said Prime Minister Lee Hsien Loong on Friday Dec 31.

Businesses should expect an increase to nine percent between 2022 and 2025. 1 day agoGovt has to start moving on GST increase in Budget 2022 as economy emerges from Covid-19 says Singapore PM Lee Saturday 01 Jan 2022 0808 AM MYT Prime Minister Lee Hsien Loong says the government has to start moving on the planned increase in the Goods and Services Tax GST from 7 per cent to 9 per cent. Singapores economy is.

There have also been discussions over wealth taxes and other planned tax hikes such as whether the impending Goods and Services Tax GST increase to 9 per cent may happen in 2022. In his speech Lee also announced that the government will proceed with the increase in Singapores GST as planned in 2022. When the Government last raised the GST from 5 per cent to the present 7 per cent rate in July 2007 headline inflation had gone up by between 04 and 06.

Low-value goods bought online and imported by air or post will now be liable for GST from January 2023. Mr Wong reiterated the need to raise the Singapore governments recurring revenues given that recurrent expenditures such as healthcare and social spending will go up. Singapore News - The planned goods and services tax GST increase will take place between next year and 2025 - sooner rather than later and subject to the economic outlook Deputy Prime Minister Heng Swee Keat said yesterday.

2 days agoHe also gave a hint that the upcoming increase in the Goods and Services GST tax will be tackled in Budget 2022 which will be unveiled on Feb 18. SINGAPORE - The plan to raise the goods and services tax GST between next year and 2025 remains. Plan to raise GST between 2022 and 2025 remains unchanged.

In a Parliament debate on Tuesday Oct 5 Finance Minister Lawrence Wong said the plan to raise the GST between 2022 and 2025 remains unchanged. The Government has to start moving on the planned GST increase from 7 to 9 per cent said PM Lee Hsien Loong. The planned GST hike from 7 per cent to 9 per cent was announced in Budget 2018.

Before we move to raise the GST we will carefully assess the prevailing economic conditions as well as our needs at that point. SINGAPORE - The plan to raise the goods. 2 days agoFirst announced in 2018 the increase in GST from 7 per cent to 9 per cent is meant to help Singapore meet rising recurrent spending needs especially in.

The Singapore government has delayed the increase of the goods and sales tax GST rate to after 2021 and thus will remain at the current seven percent rate. TIME TO BITE THE BULLET. 1 day agoPlans to raise the GST from 7 to 9 per cent between 2021 and 2025 were first announced in 2018 but was later pushed back to between 2022 and 2025 because of the pandemic.

2 days agoWhile a proposed hike in the GST currently at 7 had been delayed by the pandemic the government had said it would move ahead with the increase as soon as 2022. The GST forms one important component of our system of taxes and transfers that also includes income and wealth taxes. 2 days agoAs such the Government will start moving on a planned Goods and Services Tax GST increase in Budget 2022 which will lay the basis for sound and sustainable government finances for the.

18 hours agoSingapores Budget 2022 will be unveiled by Finance Minister Lawrence Wong on February 18. The government had previously said that the GST increase - by 2 percentage points to 9 per cent - would take place at some point between 2022 and 2025 with the expectation to implement it sooner rather than later. PM Lee noted that Singapore needs a vibrant economy to generate the resources to realise its goals and the government must have reliable and adequate revenues to carry out its social programmes.

On Sep 4 the police received a report that the man had allegedly transmitted by electronic means obscene materials in the form of images and videos of his private parts. The Government will have to start moving on the planned hike in Goods and Services Tax GST in Budget 2022 given that the economy is emerging from COVID-19 said Prime Minister Lee. The GST in Singapore was last raised more than a decade ago in 2007 to seven per cent from five per cent.

Singapore Boosts Spending To Counter Virus Economic Threats

India Monthly Gst Collections 2020 Statista

Gst Singapore A Complete Guide For Business Owners

Consumers To Pay Rs 21 344 In Taxes For Iphone 13 Mini Up To Rs 40 034 90 For Iphone 13 Pro Max Businesstoday

Corporate Travel Corporate Travel Booking Hotel Vacation Packages

46th Gst Council Meet On Dec 31 To Discuss Rate Rationalisation The Economic Times

Retail 16000 Fire Sale 10000 Wire New Rolex Black Dial 31mm Oyster Perpetual Date Just With Yellow Gold And Diamonds Come Rolex New Rolex Oyster Perpetual

Gst Clearing Accounts In Accounting Definition Examples Video Lesson Transcript Study Com

What India Can Learn From Failure Of Malaysia S Gst

The Gst Tax Rate Structure In India Download Table

Gst Singapore A Complete Guide For Business Owners

Gst Singapore A Complete Guide For Business Owners

Gst Singapore A Complete Guide For Business Owners

India Number Of Gst Taxpayers In India 2020 By State Statista